Investment is indeed a word that gives an individual sleepless night. The various bubbles which occupy an investor's mind are stocks, bonds, mutual funds, fixed deposits, gold and finally real estate. The options are endless and many but there have to be one fine decision which can take care of your savings in a right way also yielding a hand full of profits. One should invest in options which ensure utmost safety and proper gains in the crucial times. All the options available for investment have their own negative and positive points.

It is advised that one should always go for an expert guidance to make a safer investment as it’s the matter of your own savings and hard earned money. One should always go with a much secured option when it comes to investments. Witnessing the current trend there raises a question in the minds of many that why the real estate investment is a runway hit among the investors. Henceforth, the article focuses on the facts which make buying and selling properties in real estate a very profitable option.

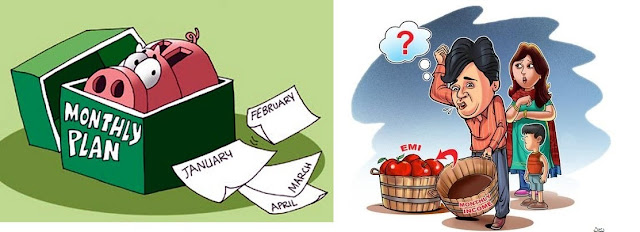

The Retirement Income

The latest economy does not believe in the trend of saving and as a result of the cosmopolitan lifestyle there is huge pressure on the income which is lavishly spend covering expenses like school fees, fuel bills, marriage funds and many others. Due to all this pressure exerted the saving accounts is savings account of the individuals is receiving thinner and thinner checks. The real estate provides a steady growth of savings when the person after retirement plans not to work and can gain a steady income by means of these small real estate investments he can also indulge in renting properties which can later fetch him income is variable amounts. Thus, this will not force him to withdraw money from the saving accounts in terms of unforeseen events.

Confident Cash Flow

Real estate is a good option as it offers positive gains on a future date and also good returns on the investments made. This sector offers a guaranteed tangible income of your investments. This indeed justifies a positive and a confident cash flow. The cash flow can also be achieved while renting apartments and villas which will generate income in terms of rents. Taking the case of Bangalore where the rentals are uprising due to a bunch of reasons. A positive cash flow is assured indeed.

Tax Benefits

Taxes are a bane in our existence and are a necessary evil. The real estate investments can give a needed tax breather. India’s major contributor to the GDP is the real estate industry. A tax expert should be hired who could give you a clear picture on how to real most of the benefits from investing in real estate. The experienced advisor will advise you on how you can save on taxes while investing in this sector. The tax break extent depends on the income bracket an individual falls in-between.

Controllable Leverage

The real estate is a sector that provides an easy leverage and also an ability to use borrowed capital to ensure potential and positive return on investment. In the realty sector one can play only 20 percent of the whole property cost and the rest 80 percent could be paid by the means of home loan triggering the use of borrowed capital in from of home loan. This edge makes the investment in the real estate sector much more lucrative. Therefore, it’s a very safe bet as the ROI is assured and much secured.

Continued Appreciation

The real estate industry observes massive appreciation on the properties. Investments made in this sector assure a guaranteed appreciation. This appreciation is periodic in nature. The investments made in the real estate sector have receives a major percentage of appreciation in the times passed by. Taking the example of Bangalore the prices have receive a massive hike and the appreciation tag ranged between 20 to 30 percent. Thus, investments made in this sector will yield higher returns.

A Diversified Investment Portfolio

Adding real estate to the investment portfolio will bring on versatility to your investments and will surely yield better returns. This diversification will indeed lessen the risk and burden over other investments. Investors from all the stages mainly national or international aim to benefit from the investments and having a varied investment portfolio will definitely fetch better ROI. When compared to the Gold industry which is prone to frequent price fluctuation the realty sector is found to be more stable and secure.

Thus, the real estate industry is a potential sector for investing your hard earned money and also it provides returns which are better in monetary terms. Owning a property is also similar like gaining an emotional confidence as investing in a home or a roof is considered as a potential asset. Apart from the monetary constraint it’s more of an emotional link up and an urge which is fulfilled by owning a house of your own or even by investing the real estate market.

This article published by Dreamz Infra 001 Blog. If you're looking to check with Dreamz Infra existing customers then click below link: